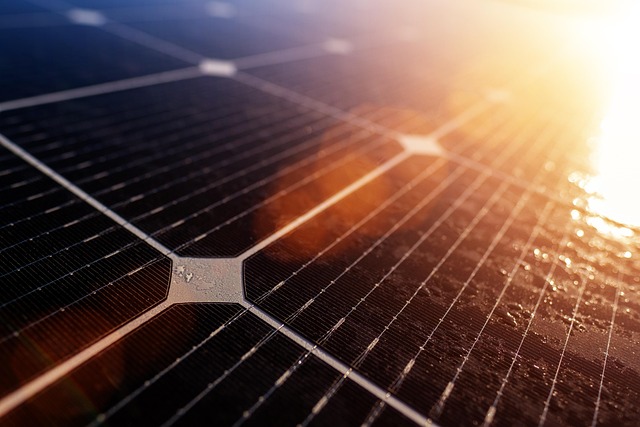

Phoenix solar panel tax credits and rebates offer substantial financial savings for both residential and commercial systems through federal and state incentives. Key programs include the Investment Tax Credit (ITC), Arizona Property Tax Exemption, and Phoenix Solar Rebate Program. To maximize benefits, homeowners should research eligible systems, consult local experts on legislative updates, ensure property eligibility, and compare installer offers. These credits and rebates significantly reduce energy costs while promoting environmental sustainability.

In the quest for sustainable energy solutions, Phoenix solar panel tax credits and rebates emerge as powerful incentives, encouraging residents to embrace renewable power. As the world shifts towards cleaner energy sources, understanding these financial benefits is crucial for those considering solar adoption. This article delves into the intricate details of Phoenix’s solar tax credits and rebates, demystifying a process often perceived as complex. We guide you through the available incentives, providing valuable insights to navigate this landscape efficiently. By the end, readers will be equipped with the knowledge to capitalize on these offers, making informed decisions for a greener future.

- Understanding Phoenix Solar Panel Tax Credits

- Navigating Phoenix's Rebate Programs for Homeowners

- Maximizing Savings: A Guide to Solar Tax Incentives

Understanding Phoenix Solar Panel Tax Credits

The phoenix solar panel tax credits and rebates offer significant financial incentives for homeowners and businesses looking to install solar energy systems. Understanding these credits is crucial in maximizing savings and offsetting the initial investment in renewable energy solutions. In recent years, the Phoenix federal solar credit status has been a topic of interest, especially with predictions that it may change by 2026. This shift could impact the economic viability of solar panel adoption, making it vital for prospective adopters to be informed.

Currently, the U.S. federal government offers the Investment Tax Credit (ITC), which allows taxpayers to deduct a certain percentage of the cost of installing solar panels from their taxable income. The Phoenix solar panel tax credits, in this context, refer primarily to this ITC, which stands at 30% for residential systems and 26% for commercial ones as of 2023. Additionally, many states within the Phoenix metropolitan area have their own rebates and incentives, further enhancing the financial benefits. For instance, Arizona offers a state tax credit of up to $1,500 per kw of installed solar capacity, providing an extra layer of support.

While these credits and rebates are substantial, it’s important to note that they are subject to change based on federal and state legislative decisions. As the Phoenix federal solar credit status evolves, homeowners and businesses must stay informed about the latest regulations. This proactive approach ensures that any plans for solar panel installation align with the most up-to-date tax incentives. To make informed decisions, consider consulting with local experts or energy consultants who can provide real-world insights into how these credits have impacted the Phoenix market in the past and what trends indicate for the future, including the potential transition to the Phoenix federal solar credit status by 2026.

Navigating Phoenix's Rebate Programs for Homeowners

Phoenix homeowners looking to invest in solar power have a significant advantage thanks to the city’s robust phoenix solar panel tax credits and rebates. Navigating these programs can seem complex, but understanding the available incentives is key to maximizing savings on your energy bill and contributing to a sustainable future. As of 2026, the federal solar credit status remains an attractive option for Phoenix residents, providing a significant financial boost for those who install eligible solar systems.

The city offers several rebate programs designed to encourage the adoption of solar energy. One notable program is the Arizona Property Tax Exemption, which allows homeowners to exclude a portion or all of their solar system costs from property taxes. Additionally, the Phoenix Solar Rebate Program provides direct financial assistance, typically in the form of a check for a percentage of the total installed cost. These rebates can significantly offset the initial investment in solar panels, making them a compelling incentive for any homeowner considering renewable energy sources.

To take advantage of these phoenix solar panel tax credits and rebates, homeowners should thoroughly research eligible systems and contractors. It’s essential to ensure that the solar installer is licensed and reputable, as only certain types of systems qualify for rebates. Homeowners can contact local authorities or consult with experts to verify eligibility and maximize available savings. By staying informed about these programs and taking proactive steps, Phoenix residents can make a significant impact on their energy costs while contributing to a cleaner environment.

Maximizing Savings: A Guide to Solar Tax Incentives

Maximizing savings through phoenix solar panel tax credits and rebates can significantly reduce upfront costs and accelerate the return on investment for homeowners and businesses alike. One of the most substantial incentives is the federal solar tax credit, which has been a game-changer in promoting renewable energy adoption. As of 2026, the Phoenix federal solar credit status remains favorable, offering a 30% tax credit for qualified solar installations, effectively reducing costs by up to one-third. This incentive is available for both residential and commercial properties, encouraging more people to switch to solar power.

For instance, a homeowner in Phoenix investing in a 10 kW solar panel system could expect savings of approximately $3,000 to $5,000 after applying the federal tax credit. Additionally, many states, including Arizona, provide further support through state-level rebates and incentives. These can include grants, low-interest loans, or property tax exemptions for solar installations. It’s crucial to check with local authorities to understand the full range of phoenix solar panel tax credits and rebates available, as eligibility criteria and amounts vary.

To maximize these savings, homeowners and business owners should act strategically. Firstly, ensuring your property qualifies for the incentives is essential. Secondly, compare offers from multiple reputable solar installers to secure the best deal. Thirdly, stay informed about changing legislation regarding phoenix solar panel tax credits and rebates, as updates can impact your potential savings. By availing themselves of these incentives, residents and businesses in Phoenix can not only reduce energy costs but also contribute to a more sustainable future.